Increased international travel, longer lead times, short stays and highly variable rates: SiteMinder’s Hotel Booking Trends highlights the dynamic new reality facing UK hotels

A new report by SiteMinder, the name behind the only software platform that unlocks the full revenue potential of hotels, provides a wealth of insights for luxury accommodations, as increasingly sophisticated guest behaviour necessitates improved revenue management strategies. The report also reveals the 12 marketing channels driving the most revenue for UK hotels, with Mr and Mrs Smith and Off-Peak Luxury continuing to deliver.

SiteMinder’s Hotel Booking Trends, based on more than 115 million hotel bookings, reveals that international arrivals at UK hotels grew by 17% year-on-year to become a majority, at 52% of all check-ins last year. This aligns with global trends, with SiteMinder’s data showing that international arrivals increased by an average of 33% across all markets.

The top source markets for UK hotels were the US, Germany, France, Australia, and Italy. Meanwhile, in line with a strong rebound of outbound Asian travel, China’s Trip.com rose from eleventh to seventh place in SiteMinder’s list of top booking channels for UK hotels, while Agoda, popular among travellers throughout Asia, climbed one spot to fifth.

Regarding the long-awaited return of Asian travellers, and Chinese travellers in particular, SiteMinder’s Chief Growth Officer, Trent Innes, says: “Hotels would do well to prepare for a change in the mix of travellers arriving at their doorstep, by revising their marketing strategies to reach the world’s fastest-growing travel sources and gaining intelligence on these potential customers to maximise their revenues.”

Partly driven by increased international bookings, the average lead time for UK hotel bookings grew to 41 days last year, 7% longer than in 2022 and over four days more than in 2019, putting hoteliers in a stronger position to forecast occupancy throughout the year, and manage and drive upsells.

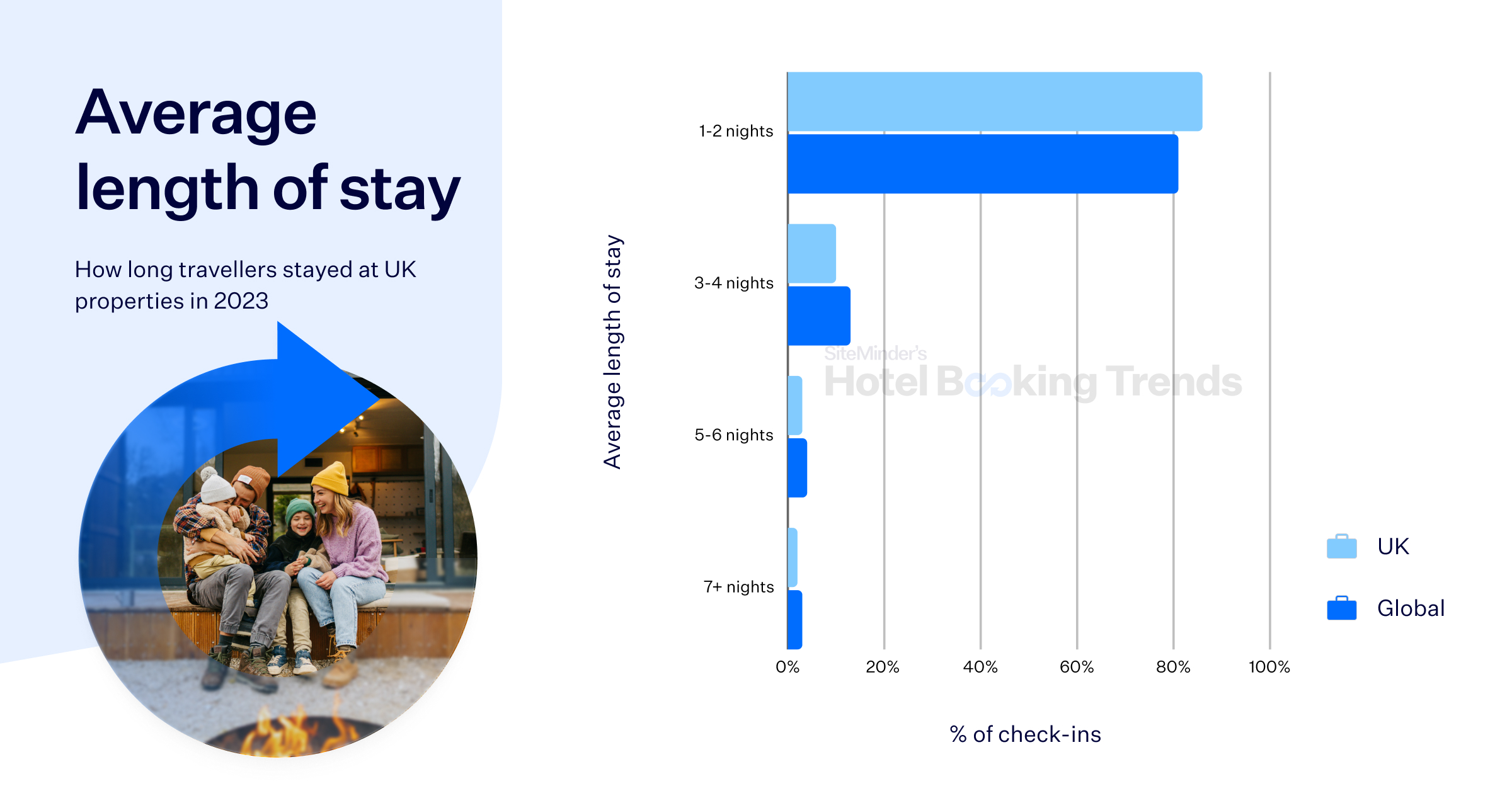

‘Short break’ experiences from both domestic and European visitors continue to be a major driver of the sector’s recovery, as well as highly-mobile travellers from further afield spreading their visit across multiple destinations in a relatively small country. Stays at UK hotels were among the world’s shortest, with 86% being for 1-2 nights and 96% for 1-4 nights.

The importance of short-stay luxury staycations for UK hotels is further underlined by the strong performance of domestic marketing channels focussing on high-end properties, such as Mr and Mrs Smith and Off-Peak Luxury. Both made SiteMinder’s annual Top 12 list for small properties, in 11th and 7th place, respectively.

SiteMinder’s vice president of ecosystem and strategic partnerships, James Bishop, says: “The strength of the short-stay market in the UK represents a double opportunity for the country’s accommodation businesses. Hoteliers seeking increased occupancy may wish to consider packages designed to attract these short-stay guests, for example by providing amenities to attract business travellers, or inclusive packages for short-stay leisure travellers.

“Alternatively, hoteliers might be looking to increase the length of stay among their guests. In these cases, creating promotions and offers, both directly and through distribution channels, can help to encourage bleisure travel, by enticing business guests to include a couple of days of ‘me time’, or sealing the deal for existing leisure travellers to take that extra night.”

Regarding cancellation rates, which at 21% were slightly above the global average (20%) and remained 3% higher than in 2019, Bishop comments: “Hoteliers must be prepared for the possibility that cancellation rates won’t return to the rates they have been used to. We are living in a new era of travel and, as with everything in the sector, cancellation trends may have found their new normal, with guests becoming accustomed to the greater flexibility that hotels have offered in recent years. Customers are also becoming more savvy to changing prices, similar to what they experience when booking with other travel sectors such as airlines, and after they secure a reservation with a flexible rate, they’ll now often shop around. And, that’s not necessarily a bad thing––offering flexibility should allow hoteliers to demand a higher rate than those with no cancellation policy.”

Variable prices reflect more dynamic revenue management strategies

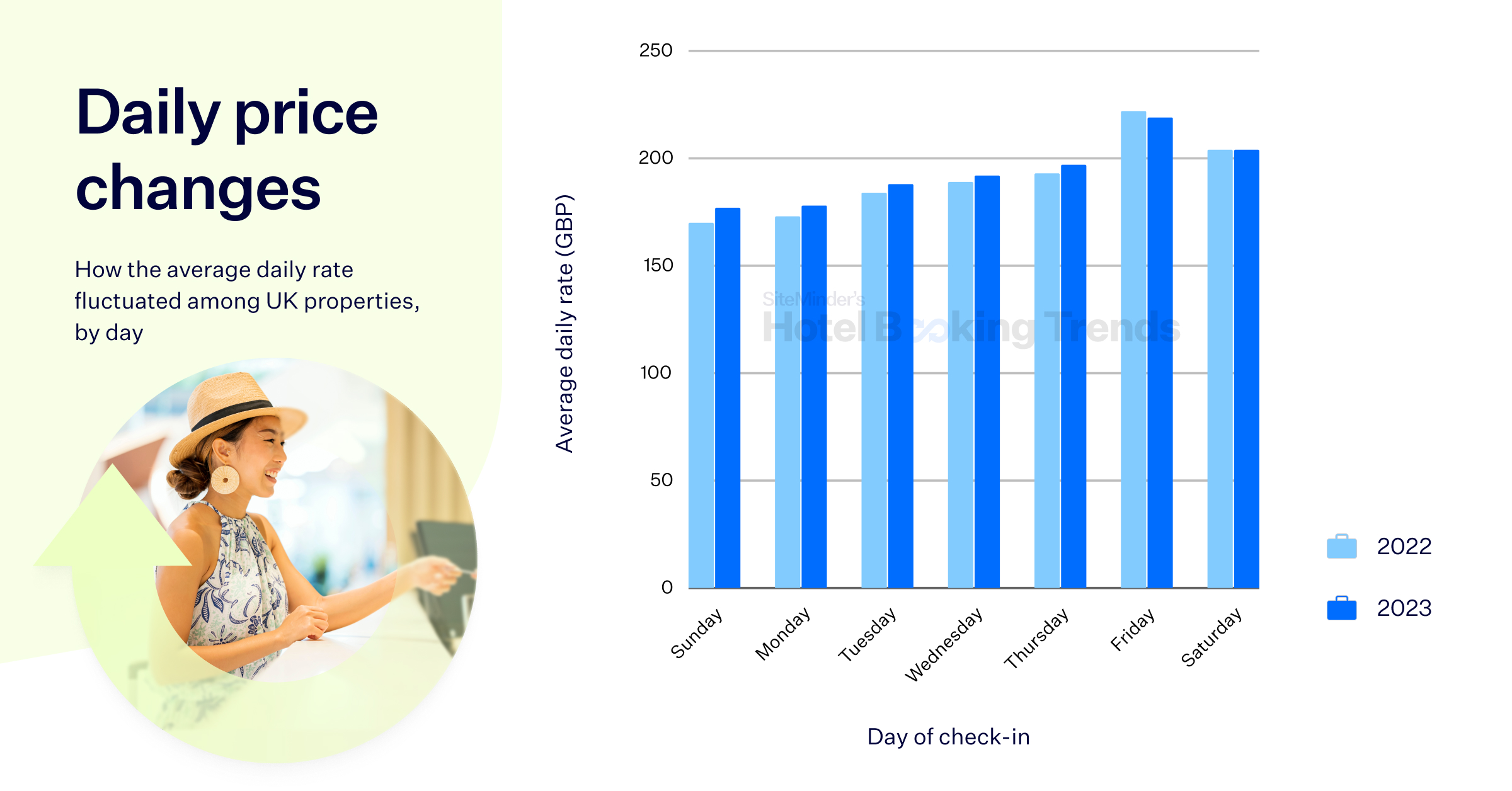

The increase of international arrivals and lead times came despite higher prices, with the average daily rate jumping 8% from the year before, to £193. ADR unsurprisingly peaked during the summer holidays, averaging £213 in June 2023, while January was again the cheapest month for guests, with an ADR of £155.

The UK had one of the world’s highest day-to-day variations in ADR. The most lucrative day for hotels was Friday, which averaged £42 more than the cheapest day, Sunday, with an ADR of £219 vs £177. The second most expensive days were Saturday (£204) and Thursday (£197).

Bishop believes that the UK’s highly variable ADR reflects an evolution towards more dynamic revenue management strategies by hoteliers as they seek to keep pace with ever-more savvy, tech-enabled customers.

“SiteMinder’s data and research shows that while international travel is returning strongly, and traveller demographics are normalising, today’s guests are a strong departure from those that hoteliers once knew. Increasingly, travellers have a nuanced approach to spending. While they are experience-driven and prepared to purchase extras beyond the cost of their room, they are more often turning to packages and promotions that allow them to continue travelling the way they know and love,” says Bishop.

“This increasingly sophisticated traveller behaviour underscores the need for hoteliers to be dynamic in the way they do business. We already see signs of this—for example, the UK has some of the world’s highest day-to-day variation in room rates, indicating that hoteliers are already adopting nimbler practices to keep pace with changing customer preferences. As international and business-related travel ramps further, it’s vital for the hotel industry to continue evolving, to ensure it is monetising revenue opportunities at every customer touchpoint,” concludes Bishop.

The annual SiteMinder’s Hotel Booking Trends report is the most authoritative analysis of the hotel bookings made by the world’s travellers. The data is based on the booking data of SiteMinder’s more than 41,000 hotel customers, which in 2023 used SiteMinder’s platform to secure more than 115 million bookings valued at more than US$45 billion in revenue. It is available in full here.

UK hoteliers are also invited to a webinar on February 29, where the report’s findings will be discussed in-depth. Hoteliers can register here.